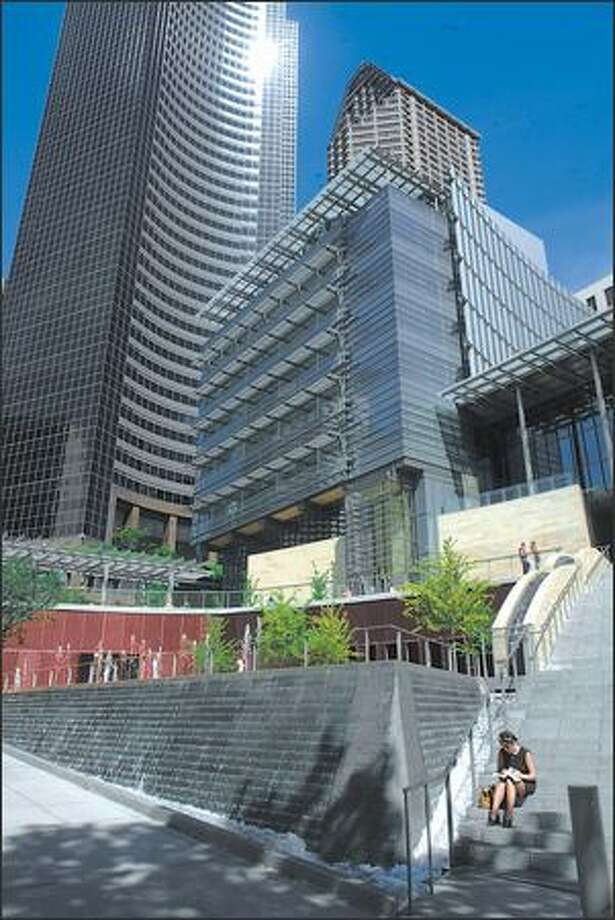

The problem of unlettable space will, they reckon, fall on secondary, lower-quality offices. Instead, he argues, the impact is more likely to be a reduction in floor space of about 10 per cent, since companies will still need space for days when most of their employees are in and because there will be a shift towards less densely populated offices.Ībove all, developers behind skyscrapers believe their new products will be insulated from reduced demand for London office space. The director of one big London developer told the AJ that, even if the average worker were only to attend the office three days a week – 60 per cent of the work time they used to spend there – companies would be unlikely to reduce their floor plates by the equivalent 40 per cent. So, given the shifting sands of the ‘new normal’, will all this extra floor space go to waste? It now says it expects about three-quarters of its 20-year target to be met in the first 10 years – by 2025/26. By the middle of 2020 it said it had already seen a net increase of floor space of 578,000m 2, with 765,000m 2 under construction and 570,000m2 granted planning permission. In 2016, before either coronavirus or Brexit, the City of London estimated it would need an extra 2 million m 2 of floor space by 2036. This all comes as the City of London sits on an enormous pipeline of new office space. London’s population has tumbled by about 700,000 people, led by an exodus of foreign-born residents since the start of the pandemic, according to the government-funded Economic Statistics Centre for Excellence. The number of workers in the capital has also decreased. Firms such as Legal & General are lobbying the government to incentivise home working and working from local desk space as a way of promoting regeneration outside of central London. ‘Companies will still need space for days when most employees are in, and there will be a shift towards less densely populated offices’ĭemand for Square Mile offices could also shift to outer London or even other cities. While the future level of home working is hard to predict and will vary by industry and sector, it looks likely that businesses will be consolidating their office floor space over the coming years as lease agreements end.Ī survey by commercial estate agency Cushman & Wakefield and George Washington University found that 80 per cent of businesses are expecting to switch to hybrid working in the future, while some companies, such as newspaper publisher Reach, have already said they will scrap almost all their London office space. But the data also reflects a once-in-a-lifetime seismic shift towards home working, which is unlikely to completely disappear, even if the coronavirus does. Of course, due to the pandemic, the new figures cover an ‘unprecedented’ 12-month period. This surplus can be explained by take-up rates: in the year to February 2020, about 1.2 million m 2 had been leased in central London, compared with just 465,000m 2 in the year to February 2021. According to real estate firm CBRE, roughly 2.3 million m 2 of office space was available to let in central London in February 2021 –almost double the 1.2 million m 2 reported in February 2020. Over the past year, the amount of empty office space in central London significantly exceeded the amount of space that was newly leased. Source:Fletcher Priest Architects/ Jason Hawkes The relentless office pipeline

So how are architects and developers redesigning – and future-proofing – the office tower? And when do experts predict an end to the seemingly insatiable enthusiasm for City of London skyscrapers – if ever?ĥ0 Gracechurch Street, by Fletcher Priest Architects, won planning permission in 2021

Quite soon banks are going to shy away from these buildings as will pose too a big a risk,’ he told the AJ Summit last month.

‘It’s a 20th-century typology which we should be moving on from. ‘The design of office towers hasn’t evolved,’ he says. ‘It seems crazy to be building like this amid a climate crisis,’ argues Simon Sturgis, an architect advocating net zero carbon design through his practice, Targeting Zero. Can the glut of shiny new office space coming to the City of London still be shifted for a profit when home working or hybrid working cuts demand for desk space? And, if it can, where does that leave the swathes of existing, and increasingly empty, office space?Īdded to this is the looming issue of the climate emergency – a growing concern for politicians, businesses, and the public alike.

0 kommentar(er)

0 kommentar(er)